how to become a tax accountant uk

View all accounting courses. How to register and get authorised as a tax agent to deal with HMRC -.

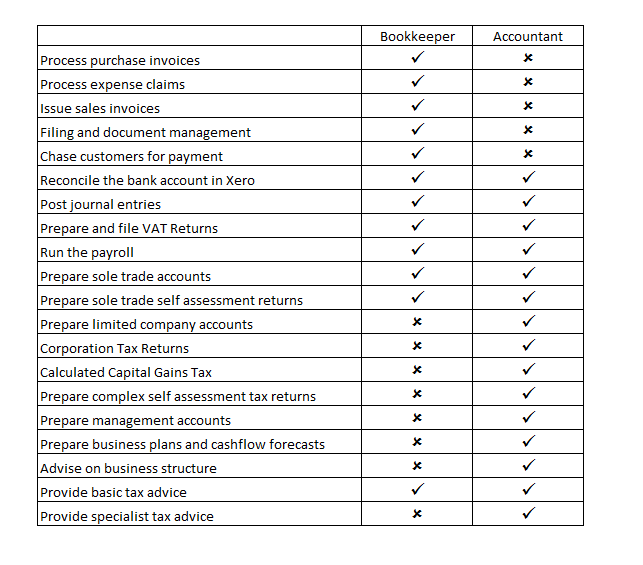

Difference Between A Bookkeeper And An Accountant

This could be a Bachelor of Accounting or a Bachelor of Accounting and Finance.

. In any case once you have been hired by an accounting firm you will need to log a minimum amount of project hours and pass the CPA exam in the US or the ACCA exams in the UK. If youve strong numeracy skills an analytical mind and are good at managing money discover all you need to know about becoming an accountant in the UK. Complete a Bachelor degree in the field of accounting.

To become an accountant you can pursue one of the following streams. Having a degree in one of the above-mentioned fields may qualify you to work in some entry. How to become a tax accountant.

You want to become a Staff Accountant Tax Staff but you dont know where to start. Many people study the requisite accounting qualifications alongside full-time work within an accounting role to gain relevant experience alongside their studies. The more common ways to become a tax accountant include.

However none of them requires GCSEs for their fundamental courses. To successfully achieve the ACA qualification you must demonstrate that you have. Having a certified public accountant license is a plus.

Discover the steps and the career path to progress in your career as a Staff Accountant Tax Staff. In fact most successful tax accountants improve their skills over time meaning their learning doesnt stop after graduating from an undergraduate program. Become a tax accountant uk.

This is a two-year degree for students with previous tertiary qualifications. Specialist courses run by professional bodies. Then you can declare yourself certified or chartered.

And have advanced your ethical understanding and professional scepticism. Alternatively complete a postgraduate qualification such as a Master of. To become a tax accountant individuals need to develop professional skills study for relevant qualifications and gain invaluable work experience within the industry.

On the Job training is. Passed 15 exam modules. How to become a tax adviser.

A2A - Become an accountant first and spend 510 years working for someone else doing tax work. To become a chartered accountant you need to complete a high level of qualifications and gain extensive experience. You must possess analytical attention to detail communication and math skills.

You can become a chartered accountant by taking a degree followed by professional qualifications. At college or via distance learning. Find out what you need to do to become a tax agent and act on your clients behalf.

Working towards this role. Each of the three main accounting bodies in the UK requires at least 3 GCSEs to become a professional accountant including English and maths. Its also possible to work your way up to chartered status by starting out in a more junior role for example as an accounting assistant while working towards professional.

This combination of professional development further education and practical work experience allow aspiring tax accountants to become well-rounded experts in their field. You do not need complex math skills if you want to become a tax accountant. Joining a company as a trainee and receiving professional training as your career progresses.

Most tax accountants hold at least a bachelors degree in accounting or a related discipline. Get relevant accounting work experience. You will need at least GCSEs in English and Maths alongside good grades in two or three A levels.

In fact most successful tax accountants improve their skills over time meaning their learning doesnt stop after graduating from an undergraduate program. Get relevant accounting work experience. How to become an accountant in the UK.

Start your training typically training programmes take between 18 months and 3 years depending on your study route eg. Secure a job or accountancy apprenticeship. Applicants are required to have at least three years of experience in a similar role.

How to become a tax accountant uk. Choose your accounting specialism. Becoming a tax accountant requires hard work in school but the skills you build can benefit you in numerous ways beyond the accounting field.

Choose your training route entry-level qualifications such as AAT are a popular starting point as youll need no prior experience. WHAT SKILLS DO YOU NEED TO BECOME A TAX ACCOUNTANT. Business Administration with a focus in accounting Finance with a focus in accounting Taxation.

Completed 450 days of work experience at an ATE. You can get into this job through. To become a tax accountant individuals need to develop professional skills study for relevant qualifications and gain invaluable work experience within the industry.

Take a look also at Bookkeeping courses or the ACA ICAEW. All allow you to study accountancy without any previous qualifications. To become a tax accountant youll need hard work in school but you will also gain many benefits from the study of accounting.

How to become a chartered accountant. There is often need for our services to assist clients in completing complicated tax forms or getting a tax deduction for the dependents. If you are a school leaver take a look at the AAT Qualification CIMA Certificate or ACCA Knowledge qualifications.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. Now you are a tax accountant. Or you can work towards a degree apprenticeship as an accountancy or taxation professional.

Alternatively complete a postgraduate qualification such as a Master of Professional Accounting.

Hire Vat Experts For Professional Vat Planning Tax Librarian In 2022 Financial Health Business Tax Librarian

How To Become An Accountant In The Uk Informi

Affordable Services By Tax Accountants In London At Rauf Accountants Accounting Services Tax Accountant Bookkeeping Services

Dns Associates Is Well Known Accountancy Firms In The Uk We Help All Types Of Businesses In Regards To Accountan Tax Return Tax Accountant Accounting Services

Understanding Your Tax Code Dns Accountants Coding Understanding Yourself Understanding

Client S Review In 2022 Accounting Services Tax Services Certified Accountant

Remote Proofreading Jobs Uk How To Become A Proofreader At Home In 2022 Proofreading Jobs Jobs Uk Job

Making Tax Simple For Uk Businesses Budget Planning Financial Tips Tax Accountant

Our Team Offers Customised Services To Meet Your Individual Accounting Needs We Offer Help In All Areas Secretarial Services Certified Accountant Bookkeeping

What Is The Difference Between An Accountant And A Tax Adviser Handpicked Accountants

Selfemployedproduct Tax Forms Job Info Self Assessment

How To Become An Accountant In The Uk Informi

Choose The Services Of Tax Bookkeeping In London Bookkeeping Services Bookkeeping Accounting Services

Representative Overseas Business Visa Accountant Slough Overseas Business Business Visa Accounting

What Qualifications Do I Need To Become An Accountant Babington

How To Claim Self Employed Expenses Small Business Tax Deductions Bookkeeping Business Tax Deductions List

Our Aim Is To Build A Long Term Relationship Thats The Reason We Are Best Croydon Account Who Provide Accountant For It Cont Accounting Contractors New Journey